The financial sector plays an essential role in achieving European sustainability goals

In 2018, the European Union launched its Action Plan for Financing Sustainable Growth with the aim of directing investment flows towards financing its sustainable development commitments, particularly on climate issues. This plan was then translated into various regulatory texts that now govern European sustainable finance.

The European Union’s objective, following the COP 21 and the signing of the Paris Agreement, was to reduce its greenhouse gas emissions by 40% by 2030 compared to 1990. This commitment was raised in 2021 through the “Fit for 55” roadmap, which aims to reduce emissions by 55% by 2030 and achieve carbon neutrality by 2050. This ambitious roadmap calls for massive investments: in 2021, the European Commission estimated the need for new investment flows to reach its new climate target at 350 billion euros per year over the decade, in addition to the 130 billion euros necessary to meet its commitments on other environmental issues.

The ambition of the European regulation on sustainable finance: redirecting capital flows through various mechanisms

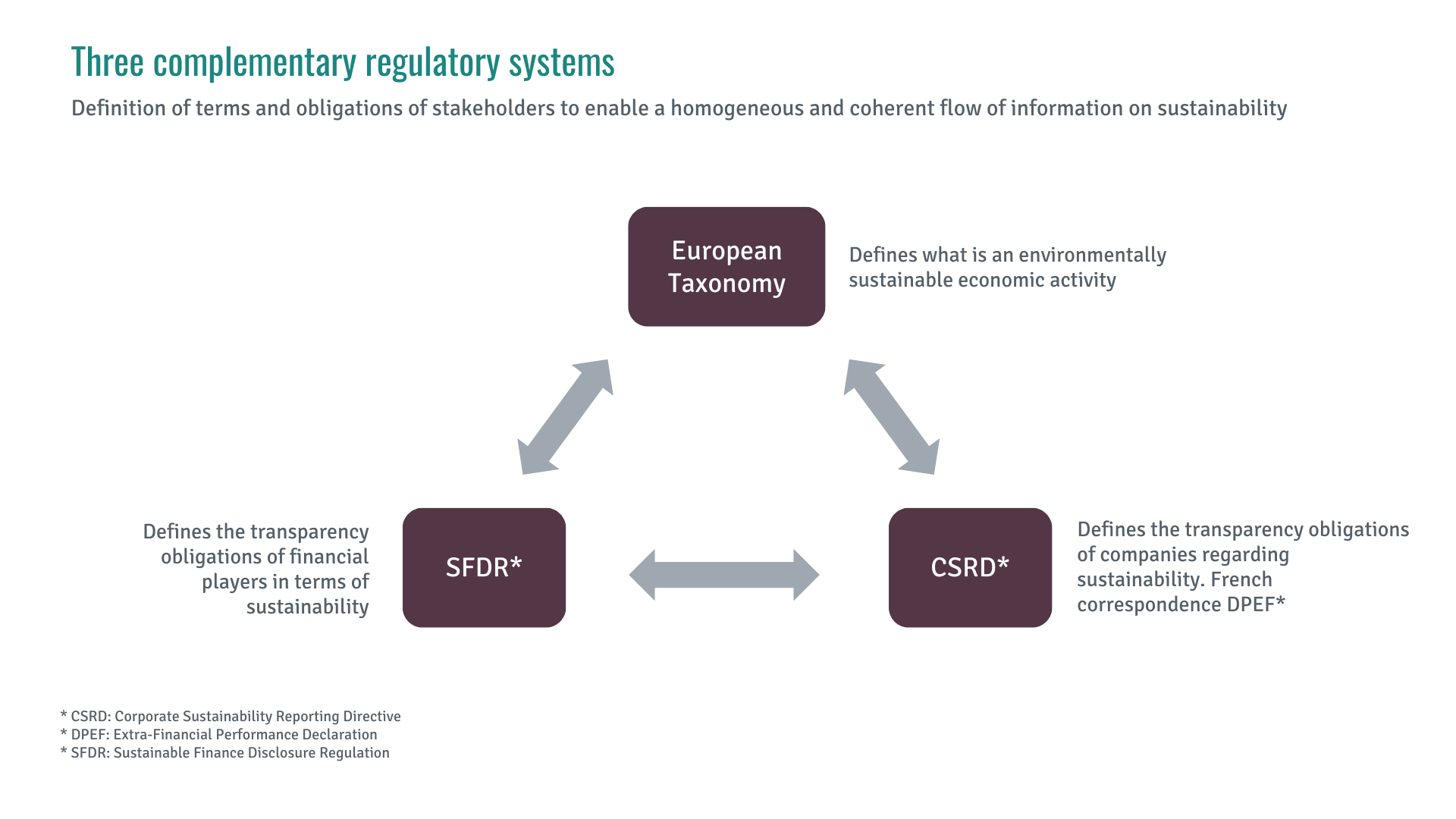

The Action Plan for Financing Sustainable Growth has given rise to a set of complementary mechanisms aimed at facilitating the redirection of capital flows. The objectives are to:

- Define activities that address transition and sustainability issues;

- Establish transparency rules for financial actors towards investors;

- Institute a framework for reporting non-financial data of companies to the market.

Firstly, the European Taxonomy Regulation, which has been progressively implemented since 2022, establishes a harmonized classification by specifying, in a common language, the criteria for defining economically sustainable activities aligned with the environmental transition. This tool is ultimately intended to measure the level of contribution of investments to the transition, or the “sustainability” level of investments.

This regulation is completed by the Regulation on the disclosure of sustainability information in the financial services sector (Sustainable Finance Disclosure Regulation – SFDR), which defines the reporting obligations for financial actors regarding sustainability. It has been progressively implemented since 2021 and is detailed in a delegated act (RTS SFDR). Understanding the content and stakes of the SFDR is essential to understand the current situation; we provide a detailed examination below.

Reportings on sustainability issues of financial actors are informed by that of financed companies, governed by the Directive on corporate sustainability reporting (Corporate Sustainability Reporting Directive – CSRD). The reporting obligations implemented by this directive will replace, with increased requirements, the Extra-Financial Performance Statement from the annual reports published in 2025 for the 2024 financial year.

Source : I Care by BearingPoint

Furthermore, since 2022, the distribution of financial products must consider the sustainability preferences of final investors under the review of the Directive on Markets in Financial Instruments (MiFID II) and the Insurance Distribution Directive (IDD). Financial advisors must inquire with their clients about their preferences regarding investment in sustainable activities, in the sense of the Taxonomy and SFDR Regulations, and integrate these preferences into the advice provided and the products offered.

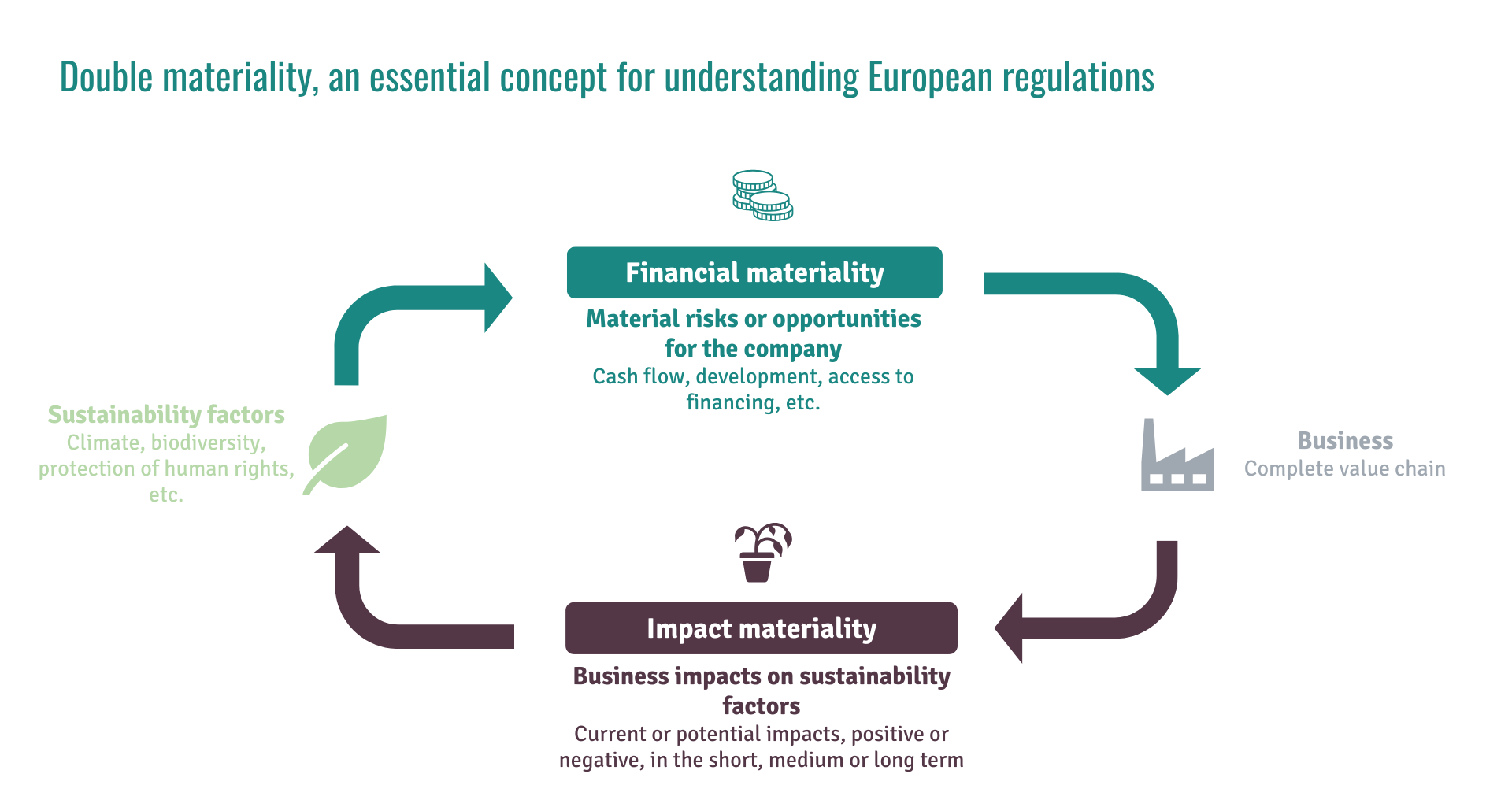

The entire European sustainability regulatory framework, through the various regulations, is based on the principle of double materiality, according to which sustainability must be assessed in terms of:

- “Financial materiality”: the effect of environmental, social, and governance issues on the economic performance of the company;

- “Impact materiality”: the effect of the entity’s activities on the environment and society.

When only financial materiality is considered, it is referred to as simple materiality.

Source : I Care by BearingPoint

The initial ambition of the SFDR Regulation, at the heart of the Action Plan for Financing Sustainable Growth

The primary ambition of the European Commission with the introduction of the SFDR Regulation is to improve the transparency of financial products to ultimately redirect capital flows. To do this, the Regulation introduces new concepts intended to be adopted by all actors:

- “Sustainable investment”, corresponding to investments that positively contribute to one or more environmental and/or social issues while not causing significant negative impacts elsewhere;

- “Environmental and social characteristics”, which are promoted by investments selected based on extra-financial criteria;

- “Principal Adverse Impacts (PAIs)”, which are a set of sustainability issues precisely listed by the regulation, with for each issue an indicator for measuring the potential negative impacts of investments on it. A financial product “takes into account the PAIs” if it implements measures to limit the negative impacts of its investments on these issues.

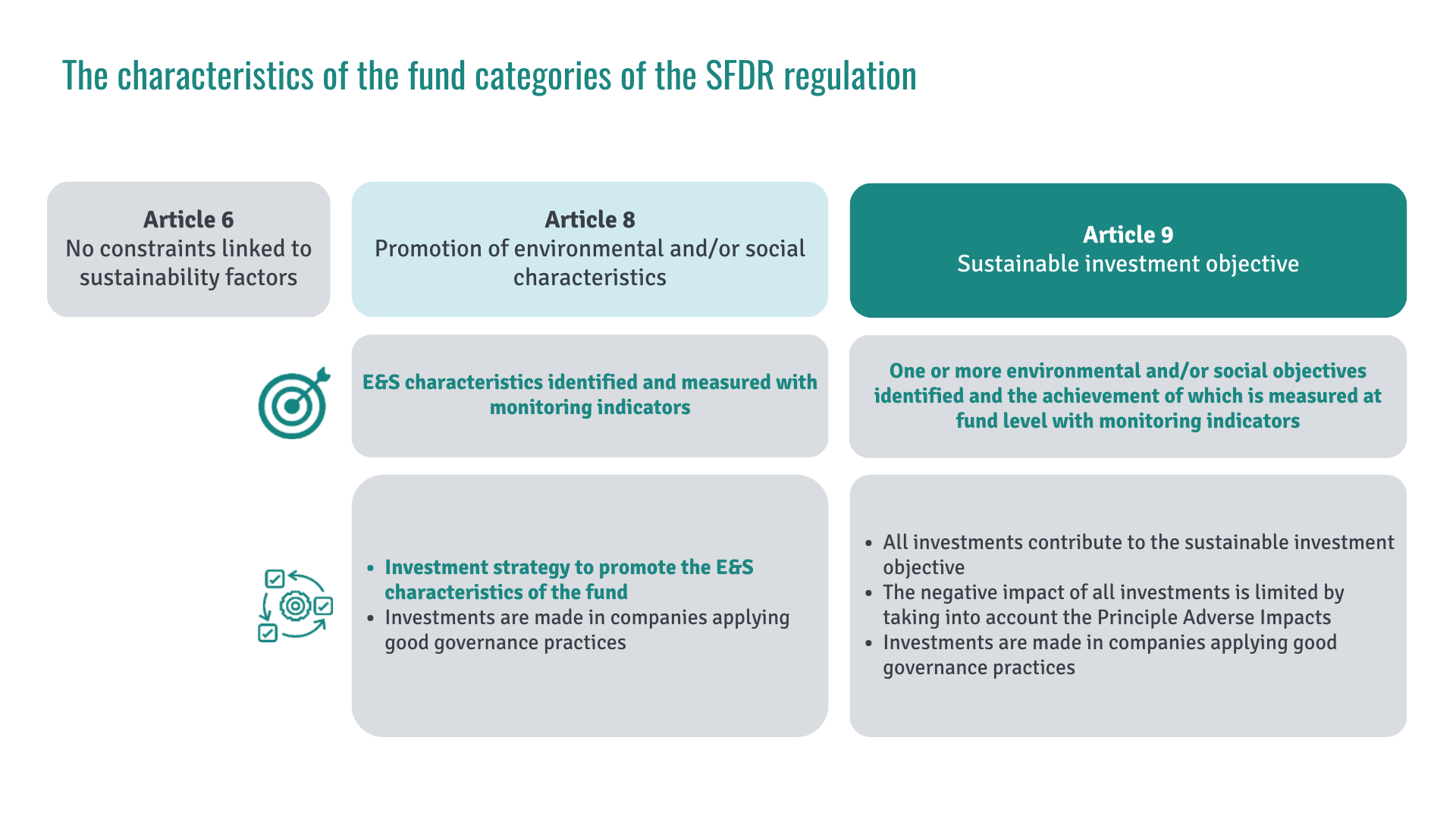

The SFDR Regulation notably introduces fund categories with the aim of imposing transparency obligations adapted to the level of sustainability ambition of the funds:

- “Article 9” funds are those with the highest level of ambition by only making “sustainable investments”;

- “Article 8” funds are those that promote “environmental and social characteristics”, which may partly make “sustainable investments”;

- “Article 6” funds represent the rest of the funds.

These categories are not intended to constitute labels but rather to provide guarantees of an adapted level of transparency to grasp the intentionality of the products offered. However, ambiguity about this function has led to very commercial interpretations of the regulation, with all the risks that this may entail in terms of greenwashing.

Source : I Care by BearingPoint

However, the European Commission has so far chosen to remain vague on these new concepts and thus leave significant leverage for financial actors. While this position is founded, particularly to lighten the burden of regulation and allow market flexibility conducive to innovation, it poses difficulties regarding the intended objective: heterogeneity of practices, difficulty of comparison between financial products, lack of readability for final investors.

Find all of our latest publications in the Infos tab of our website